Il processo di scoperta del farmaco, che implica l’estrazione di nuove conoscenze basate su prove di efficacia, è molto oneroso sia in termini di tempo sia di risorse.

Anche nel caso in cui si prosegua alle fasi successive – dall’ipotesi iniziale e dalla fase pre-clinica agli studi clinici – non c’è alcuna garanzia che si riesca alla fine a scoprire e sviluppare un farmaco effettivamente utilizzabile. In questo contesto, l’applicazione dell’intelligenza artificiale può potenziare le tecnologie già utilizzate dalle aziende farmaceutiche per accelerare le varie fasi del processo di scoperta e sviluppo del farmaco.

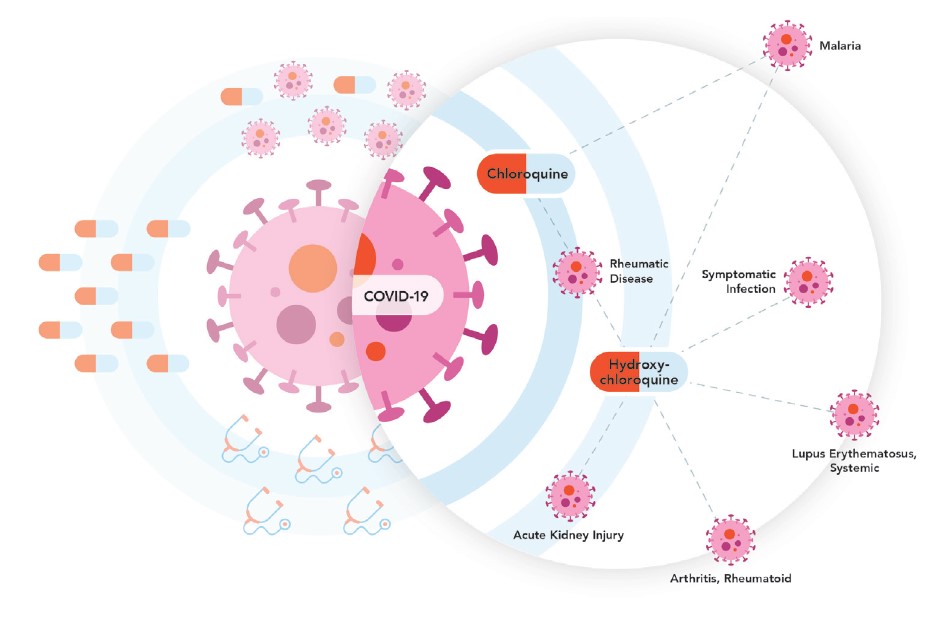

Allo stesso modo, l’intelligenza artificiale può supportare con efficacia anche il riposizionamento dei farmaci, consentendo di risparmiare costi e tempo prezioso grazie alla capacità di rendere facilmente scalabili e accurate le attività di ricerca legate ai farmaci già approvati e disponibili sul mercato, di cui si conoscono effetti e meccanismi d’azione per investigarne utilizzi diversi ed espanderne gli ambiti di impiego.

La tecnologia brevettata di expert.ai offre un efficace supporto ai ricercatori per identificare i dati chiave presenti all’interno della letteratura scientifica e per aumentare i processi sia di scoperta sia di riposizionamento dei farmaci, grazie alla capacità di individuare e collegare in modo rapido e accurato informazioni biomediche relative a patologie, farmaci, cure, sintomi, geni, proteine e altri dati.

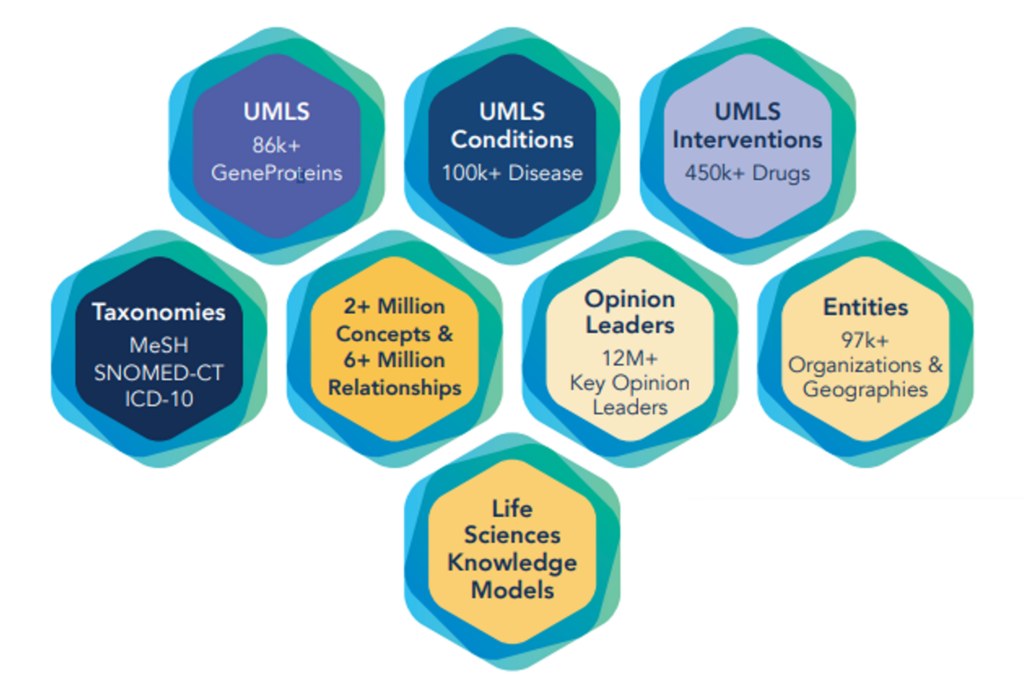

L’approccio di expert.ai si basa sull’utilizzo di un knowledge graph unico al mondo, appositamente ideato per gestire le conoscenze in ambito medico-scientifico e farmaceutico. Grazie al knowledge graph di expert.ai è possibile standardizzare e connettere dati apparentemente anche molto lontani e scollegati, raggruppando condizioni diverse in famiglie di malattie o identificando meccanismi d’azione e classi di farmaci.

Expert.ai Platform for Life Sciences aiuta i ricercatori a individuare nuovi dati ed elementi per arricchire il knowledge graph, mantenendolo così consistente e aggiornato, al passo con le frequenti evoluzioni che caratterizzano le diverse aree terapeutiche. Consente inoltre ai ricercatori di monitorare molteplici fonti e risorse di dati (dalle pubblicazioni scientifiche a prove concrete tramite la raccolta di dati clinici), con grande rapidità ed efficacia.

Vasto e approfondito, il knowledge graph di expert.ai per il settore farmaceutico consente:

La tecnologia di expert.ai applica la capacità di comprensione dei testi, simile a quella umana, al processo di scoperta e sviluppo dei farmaci, accelerando le attività di ricerca e analisi dei dati svolte dai ricercatori. Inoltre, supporta l’identificazione di nuovi utilizzi per farmaci esistenti, allo scopo di riproporre i trattamenti per altre malattie.